Ecommerce sales tax: Top 7 things you need to know

Author

Date

Category

Up until 2018, retailers only had to pay sales tax in the state where their business was physically located. It was much simpler back then. Have a shop? Great! Pay sales tax in that state.

But the increase in online stores has muddied the waters. Many of today’s ecommerce brands don’t have a physical store and instead sell products online. The kicker: they still need to pay sales tax.

So how does it work?

In 2018, a Supreme Court ruling changed the rules to account for ecommerce businesses selling products in multiple states.

In the past, a Texas-based ecommerce business could sell products in California, Colorado, and Connecticut, but would only pay sales tax in Texas. Now, the same business will need to pay sales tax in Texas, California, Colorado, Connecticut, and any other state it sells over a certain amount of dollars worth of products.

To complicate things further, each state has a different sales tax rate. For example, California’s sales tax rate is 7.25% while Tennessee and Oklahoma charge 7% and 4.5%, respectively.

If that wasn’t confusing enough, sales tax can vary within each state. In New York, sales tax can range anywhere from 4% to 8.875% depending on where in the state you’re shipping products too.

The US tax system is notoriously complex and the different rules, rates, and regulations are enough to put some ecommerce brands off. But, as long as you keep a close eye on the sales tax requirements for each state you operate in, you’ll be golden.

Here are seven crucial things you need to know about ecommerce sales tax in the US.

1. What is ecommerce sales tax?

We’ll start with the basics. Ecommerce sales tax is a tax applied to products sold online. The customer pays the tax when they purchase a product, but the company they bought it from is responsible for collecting that tax and paying it to the relevant state.

Sales tax is always calculated as a percentage of the item’s price—just like you would charge a customer in a brick-and-mortar store.

2. Who pays US sales tax?

Sales tax is applied to the sale of a product. The customer pays the tax in a lump sum when they buy an item—so the customer is responsible for paying it. However—this is the important part—it’s up to the ecommerce brand to collect the tax from each sale and file it to the relevant state or jurisdiction where the sale took place.

Let’s say your business is based in Delaware and a customer from Oklahoma buys a product from your online store. The customer will pay the 4.5% sales tax (Oklahoma’s sales tax rate) applied to the product based on their location at the checkout. It’s then your responsibility to collect the 4.5% tax from the purchase and file it in Oklahoma.

3. Be aware of your sales tax nexus

Read anything about US sales tax and you’ll come across the term “nexus”. This describes any connection your business has with a state that charges sales tax. For example, a Texas-based business has a nexus in Texas, but if it also sells a certain amount of products in Ohio, it also has a nexus in Ohio.

There are two types of nexus in US sales tax law:

- Physical nexus

- Economic nexus

A physical nexus determines where your store has a physical presence. This might indicate a physical store or it might be where your business address is registered.

An economic nexus is a state where you make a certain amount of sales and are therefore required to pay sales tax in that state. For example, if you make more than $500,000 worth of sales in California during a calendar year, you’re required to pay the state’s 7.25% sales tax on those sales even if your business has no physical presence in California.

The thresholds vary from state to state. California’s is the highest—most sit around the $100,000 mark. Very few states don’t charge sales tax. They include Oregon, Alaska, Delaware, Montana, and New Hampshire. You can sell as many products as you like in these locations without needing to collect and file sales tax.

It’s important that you know and understand the sales tax thresholds in each state you have a presence (physical or otherwise). Additionally, different states have different filing deadlines—so ensure you’re clear on when you need to submit your sales tax reports in the states you hold a nexus.

What is a click-through nexus?

There’s one more nexus to add to the mix: a click-through nexus. This describes a state that refers a lot of business to your store. For example, if you have an affiliate or referral program in New Mexico that nets you a decent amount of sales, you’ll have to pay sales tax in New Mexico.

Note that the threshold for a click-through nexus is much lower than it is for an economic nexus. Instead of the usual $100,000, the thresholds tend to sit somewhere between $10,000 and $50,000.

4. Not all products and services require sales tax

To complicate matters even further, not every state taxes products and services in the same way. Some products aren’t subject to sales tax at all depending on your nexus situation.

For example, items of clothing might be tax-exempt in one state but not another. Most states don’t apply tax to food in grocery stores, but again this varies, which is why it’s so important to check a product’s sales tax status before you add it to your store.

5. There are some sales tax exemptions

Aside from products that are exempt from sales tax, there are other situations where you don’t need to collect and file taxes. Again, these instances depend on the states you’re operating in and where your customers are based.

Here are some examples:

- Virginia allows nonprofit organizations to buy products without paying sales tax

- Colorado doesn’t charge purchasers sales tax if they’re not the final consumer—like wholesaler and reseller situations

- New Mexico doesn’t charge sales tax on products bought during certain times of the year—like back-to-school clothing and supplies

- Most states don’t charge sales tax on essential products like groceries

Bear in mind that most of these scenarios require the customer to produce an exemption certificate. To avoid overpaying, make sure you ask for and safely store valid exemption certificates from customers who qualify.

6. You must register for a sales permit

Before you can collect sales taxes in different states, you’ll need to register for a sales tax permit. This allows you to add tax to purchases and file your sales tax reports when the time comes.

In most states, it’s illegal to collect sales tax without a permit (because you could ultimately just pocket the money instead of filing it with the government).

So, before you start collecting sales tax, it’s crucial you register for a permit in every nexus state, whether it’s a physical or economic nexus. It’s worth checking state laws, too, as some states require you to get your permit before you cross the nexus threshold, while others will give you some leeway. For example, Colorado gives sellers up to 90 days to obtain a permit after they’ve crossed the economic nexus threshold).

To get a permit, go to the Department of Revenue website for the state in question and follow the steps—you’ll need your EIN and a couple of other key documents to register, so have them handy.

7. There are consequences if you don’t pay sales tax

Sales taxes are due on either a monthly, quarterly, or yearly basis. When you apply for and receive a sales tax permit, you’ll also be told your filing frequency which will depend on the state you have either a physical or economic nexus in.

When your due date arrives, you’ll need to file your report and pay the sales tax owed. If you sell products via multiple channels, you’ll need to bring all your sales figures together for each state and file them in one sales tax report.

Let’s get to it. What happens if you don’t pay sales tax or are a late-payer? The answer is, like always, it depends on the state. Most states charge a penalty or an interest fee that can quickly soar to tens of thousands of dollars if you’re not careful. In worst-case scenarios, failure to file and pay can lead to criminal convictions.

We don’t say this to scare you, but it’s an important reminder to stay on top of your filing and make sure you have sales tax permits in the states you need them in.

Ecommerce sales tax is complex but necessary: Leave it in Lemon Squeezy’s capable hands

Sales tax can feel like just another hurdle for ecommerce brands. Getting your head around which states you need to register in and how much sales tax you need to apply can be overwhelming, which is why it’s a good idea to use software that automatically applies the relevant sales tax for you.

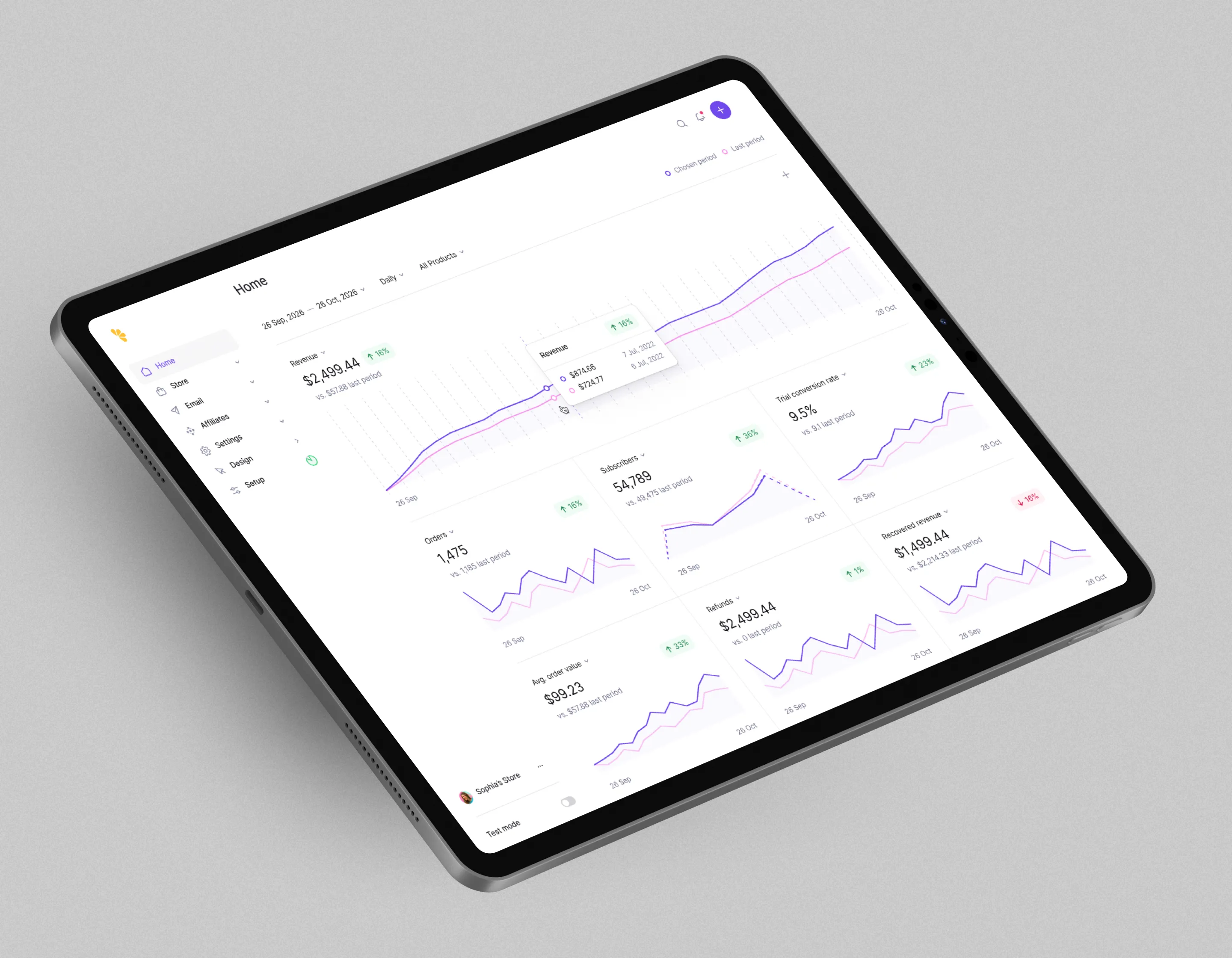

With Lemon Squeezy, you don’t have to worry about collecting and filing sales tax—it takes care of it all for you. The automated software automatically adds the correct sales tax to every sale so you don’t have to dust off your sixth-grade math ability.

Even better, since Lemon Squeezy is a merchant of record, you shouldn’t need to report sales tax on any sales you make through the platform. Instead, you can sit back and focus on what you are good at.

Whatever stage of your journey, we’re here to help

No matter the stage of your company, we stand behind our promise to provide exceptional customer support, from initial setups to massive migrations and everything in between.

Invest in your business with peace of mind that we're here for you whether you need technical help or business advice.

Creator Guide

Looking for some advice on how to sell and market your digital products? Download the creator’s guide to dive deep into getting your idea off the ground.

Merchant of Record Guide

Free guide for all entrepreneurs and organizations explaining why partnering with a Merchant of Record is more important than you might realize.

Want merch?

Want some fresh Lemon Squeezy swag with all the lemon puns you could ever imagine? The wait is almost over as we’re gearing up for a limited-time merch drop.

Book a demo today and get your own personal guided tour of Lemon Squeezy

Still have questions about Lemon Squeezy? Book a call with our sales team today and we’ll show exactly how we can revolutionize the way your business handles global payments and sales tax forever.

Need help?

If you’re looking to get in touch with support, talk to the founders, or just say hello, we’re all ears.