How to create an LLC for your online business

Author

Date

Category

If you’re looking to sell products online, it’s critical for you to set up a company for tax benefits and protection. The most common way to create an LLC.

An LLC or Limited Liability Company is one of the simplest and straightforward business structures for new start-ups and small online businesses. It’s a legal status of a commercial entity that provides the outstanding limited liability feature of corporations with a partnership’s tax advantages.

Many online businesses start off with the LLC business structure as they’re loaded with multiple features to kick off things simply. I’m here to cover everything you need to learn about how to create an LLC for your online business, so let’s begin.

How To Create An LLC

Thinking about creating an LLC? Here are 7 steps to follow to create an LLC. Additionally, some more detail as to why you should consider creating an LLC, what an LLC protects, how having an LLC can benefit you from a tax liability standpoint.

1. Choose a unique name for your business

First up, you need to decide on your company name. Ideally, you’ve already settled in on the name of your business. From a branding and marketing standpoint, keeping things consistent is ideal when it comes to locking in your LLC name.

With that said, you have to check with your state law requirements. You have to check for conflicts such as have the same name as another business which isn’t allowed in most states. Lastly, you must end your business name with LLC or Limited Company to create an LLC.

It’s also important to know that certain terms or keywords will be prohibited.

Take some time to understand your state’s LLC naming requirements. You can also check to see if the name you want is available. With a quick google search “file LLC in [your state]” and you should be able to quickly find your state’s website for business filing. In most states, that’s the Secretary of State.

2. Reserving your business name (optional)

As a note, it can take some time before filling in the documents, so be sure to reserve the name of your business so that no one else can use it. It is also recommended that you book your business name if you aren’t filling the documents right away.

3. Selecting a registered agent

For starters, what is a registered agent and why do you need one?

A registered agent is a person that will receive official documents on behalf of the LLC and pass them along to a reliable person at the LLC. There are many companies that provide registered agent services at a fee. In order to create an LLC, it is required to have a registered agent.

For simplicity, you can have anyone be your registered agent. As long as they are at least 18 years old. You’re also allowed to name yourself or an employee. The only caveat is the agent must be located within the same state. They confirm this with a valid address within your state.

Another option is to use a 3rd party. You can easily designate a company that provides registered agent services. If you go this route, there is a cost. It’s typically a few hundred dollars a year.

4. Create and file Articles of Organization

Every state has its own procedure to create an LLC. In general, your organizational paperwork file must include the name of the LLC, length of existence, name, and address of the registered agent, the LLC’s purpose, and other information.

This is also commonly referred to as your Articles of Organization.

In order to establish your LLC as a legal entity, you have to file your Articles of Organization. Note, some states may refer to it differently e.g. “Formation Documents” or “Certificate of Formation”. Within the same website to secure your business name, you’ll be able to file these documents in the same place.

As you prepare to file your Articles of Organization be sure to check over everything carefully and make sure all signatures are captured. If you’re solely owning the LLC, obviously it will only require your signatures. However, if you have multiple members or managers, you’ll need signatures from all members or managers.

One last important detail. Once you file and successfully create your LLC, you’ll receive important info such as your tax ID or EIN. You’ll need this for future tasks such as creating your bank account.

5. Establishing an LLC operating agreement

Think of an LLC operating agreement as a roadmap of how things will work in the company. From how profits and losses will be calculated to members’ rights, everything is in the LLC operating agreement.

Additionally, your operating agreement has all the details of the financial, legal, and management rights of all members of the LLC. You may want to have very specific agreements that can range from how profits will be distributed, what happens when members leave the LLC, and who contributes capital for the business. In short, it’s anything related to running and operating the LLC.

Keep in mind, an operating agreement is not a requirement by most states. However, it’s definitely in your best interest to create an operating agreement especially if your LLC has more than one member or manager.

Crafting your own operating agreement is one option, especially for single-member LLCs. And there are plenty of free templates online to get you started. For more complex situations such as LLCs with multiple owners, hiring an experienced attorney may be well worth the expense.

6. Make sure to keep your LLC active

It may sound silly but it’s easy to forget to renew your business entity once it’s established. This is commonly referred to as staying in good standing with your state. Again, refer to your state’s business filing website to look up current information on how to do so. Keep in mind, you will have to pay an annual fee as well to keep your business entity active. You may also need to file an annual report that updates information pertaining to your LLC.

7. Registering to do business in other states (optional)

Your LLC can’t do business in more than one state until it’s been registered to do business in other states. I filled out a form just like when I registered my LLC for the first time to do business in other states.

Why You Need Create an LLC

Typically you’re starting a new LLC because of the following three reasons:

- As a new business, setting up services requires business bank account information to get started.

- An LLC can help eliminate the risk of exposing your personal assets

- If your business has multiple partners, LLC can provide benefits in terms of equity splits, tax savings, operating agreements, and more.

What personally made me fall for the LLC idea was that it created a wall between my business and my personal assets. And if you share similar beliefs, then you must go for an LLC as well.

What Does LLC Protect

On paper, LLC protects your personal life from your business. It’s an additional layer of protection between you and your business. The following are some of the pointers that are protected by LLC:

- You wouldn’t be personally liable for the decisions of your partners

- Your assets will be protected even if things go sideways in your business

- LLC protects you from all the paperwork corporations have to file

- LLC reduces the risk of personal assets being targeted if the business is sued or goes in debt

Lastly, LLC also protects you from taxes. More on that in this next section.

How Does LLC Help with Taxes?

In LLC, profit and losses are passed through the business to its members, partners, and owners. This entitles every individual to pay tax on the share of their profit or personal tax return. Unlike corporations, LLCs aren’t taxed with double taxation (where the business pays taxes on profit, which are then taxed again when the owner pays their personal income tax on them).

As LLC is regarded as a single entity, the taxes are only paid once by the company, and then every member is responsible for paying their personal taxes.

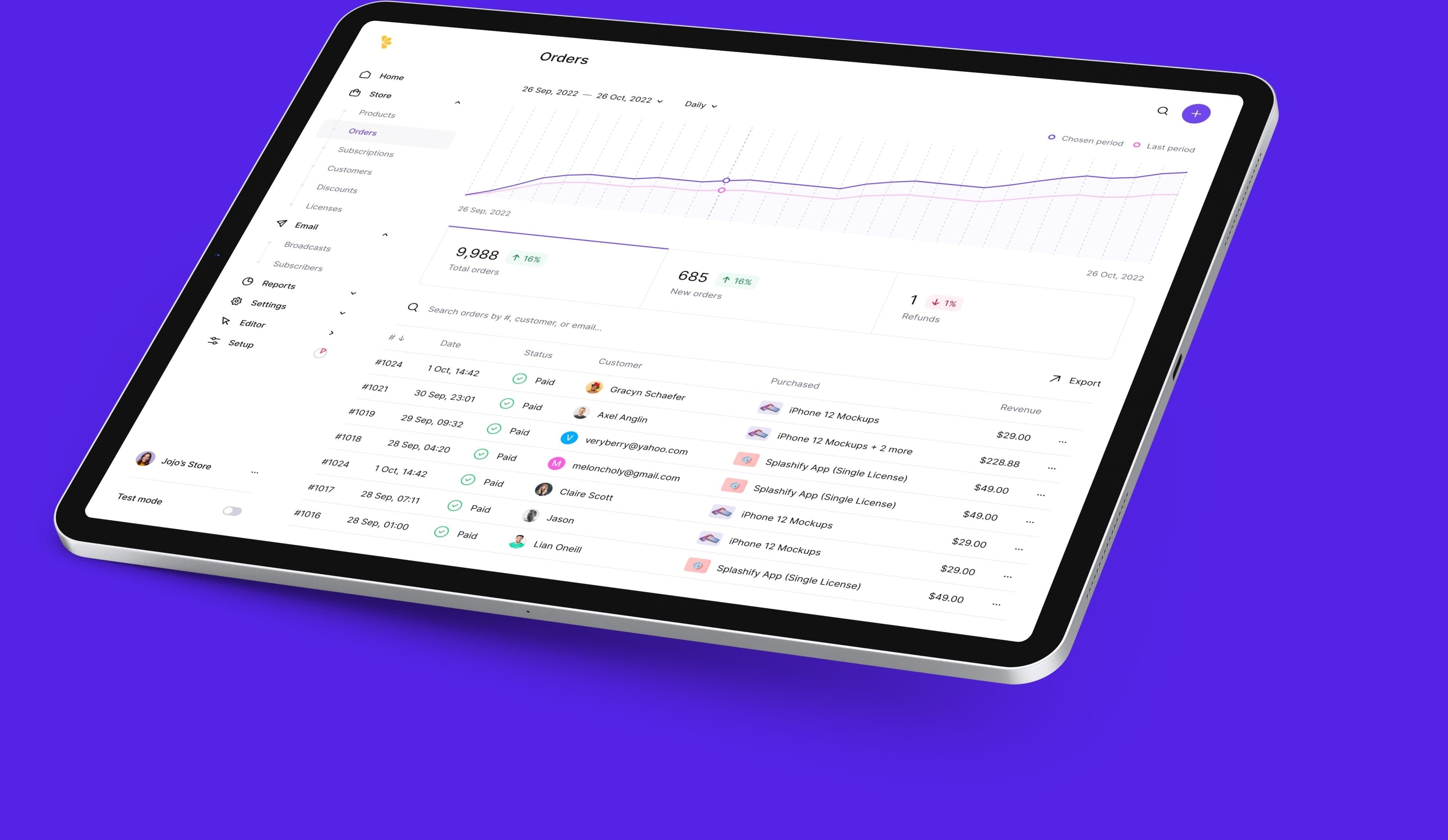

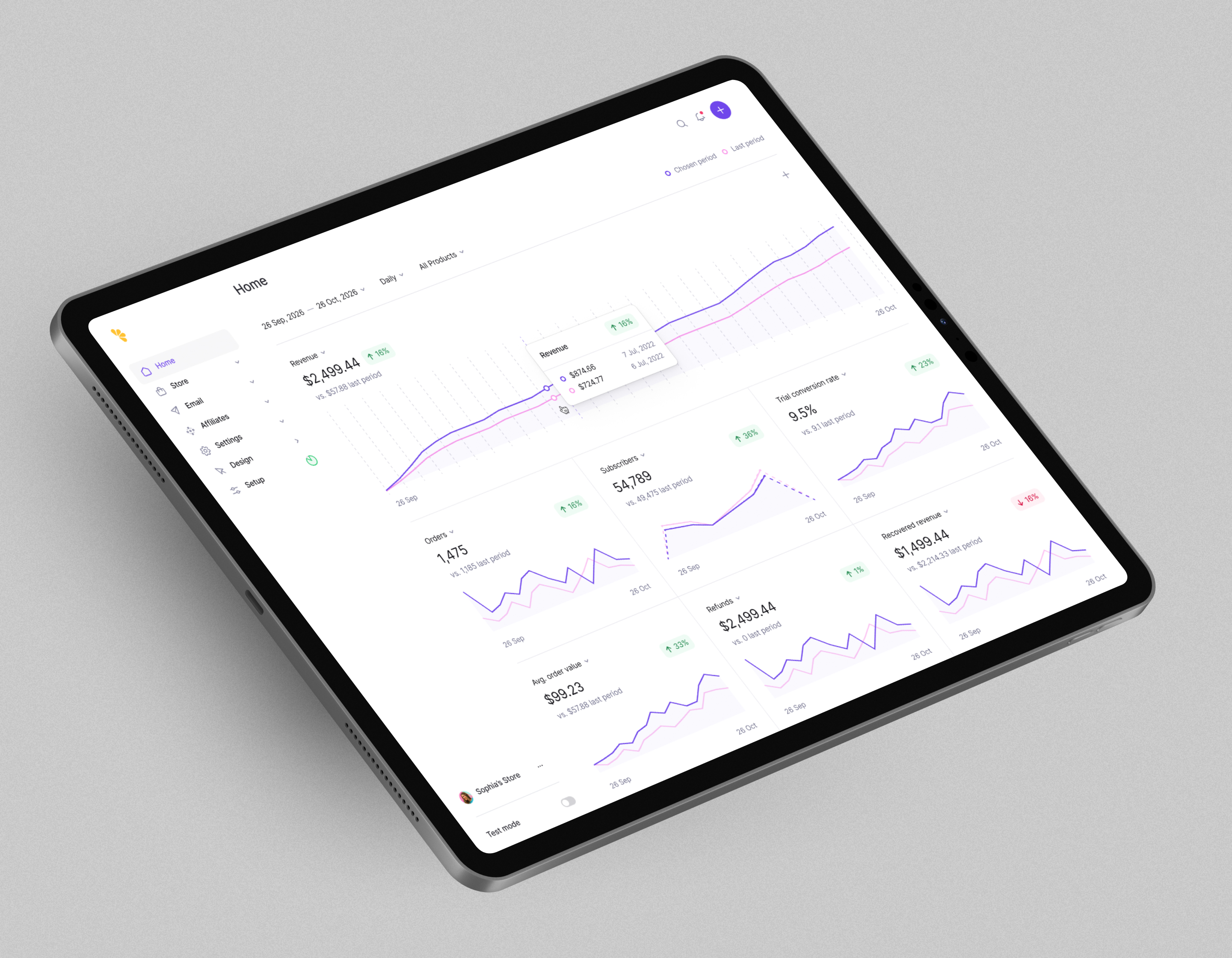

Keep in mind, this is all related to business and personal income taxes. As it relates to collecting taxes for online transactions, solutions like Lemon Squeezy act as your merchant of record which frees you up from that burden.

LLCs are inexpensive to set up. As an online business owner, it’s the best business structure that will help you in multiple ways. So, what are you waiting for? Register your LLC today and take your online business to a whole new level.

Whatever stage of your journey, we’re here to help

No matter the stage of your company, we stand behind our promise to provide exceptional customer support, from initial setups to massive migrations and everything in between.

Invest in your business with peace of mind that we're here for you whether you need technical help or business advice.

Creator Guide

Looking for some advice on how to sell and market your digital products? Download the creator’s guide to dive deep into getting your idea off the ground.

Merchant of Record Guide

Free guide for all entrepreneurs and organizations explaining why partnering with a Merchant of Record is more important than you might realize.

Want merch?

Want some fresh Lemon Squeezy swag with all the lemon puns you could ever imagine? The wait is almost over as we’re gearing up for a limited-time merch drop.

Book a demo today and get your own personal guided tour of Lemon Squeezy

Still have questions about Lemon Squeezy? Book a call with our sales team today and we’ll show exactly how we can revolutionize the way your business handles global payments and sales tax forever.

Need help?

If you’re looking to get in touch with support, talk to the founders, or just say hello, we’re all ears.